- Are you a business owner with no employees?

- Do you want to reduce your income taxes?

- Would you like to contribute more than allowed with a SEP lRA?

- Does your spouse work in your business?

Break Contribution Barriers with the Owner K

The Edward Jones Owner K, a type of “one-person 401(k),” is now the retirement plan of choice for many business owners with no employees other than a spouse. The Owner K plan has the highest contribution limits available for a business retirement plan while still offering the flexibility to determine contribution amounts year to year. The plan can be used by self-employed individuals, corporations, and partnerships wanting to maximize (with flexibility) pretax retirement contributions.

Roth Contributions in 2006

Beginning with 2006, you may contribute part or all of your salary deferral amounts (up to $15,000, or $20,000 if you are 50 or older by 12/31/06) as an after-tax Roth contribution, instead of a pre-tax traditional 401(k) contribution. Roth contributions are not tax deductible, but Roth amounts are distributed tax-free, if certain conditions are met. Roth contributions to an Owner K may make sense for you.

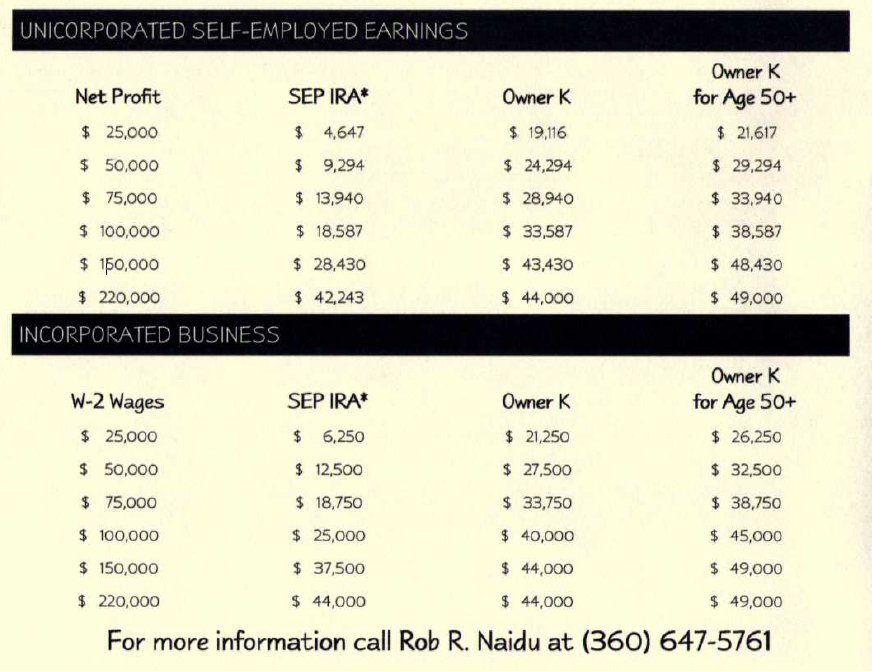

The following table compares how much more a business owner can contribute in 2006

with an Owner K.